Morning thoughts on 8.12

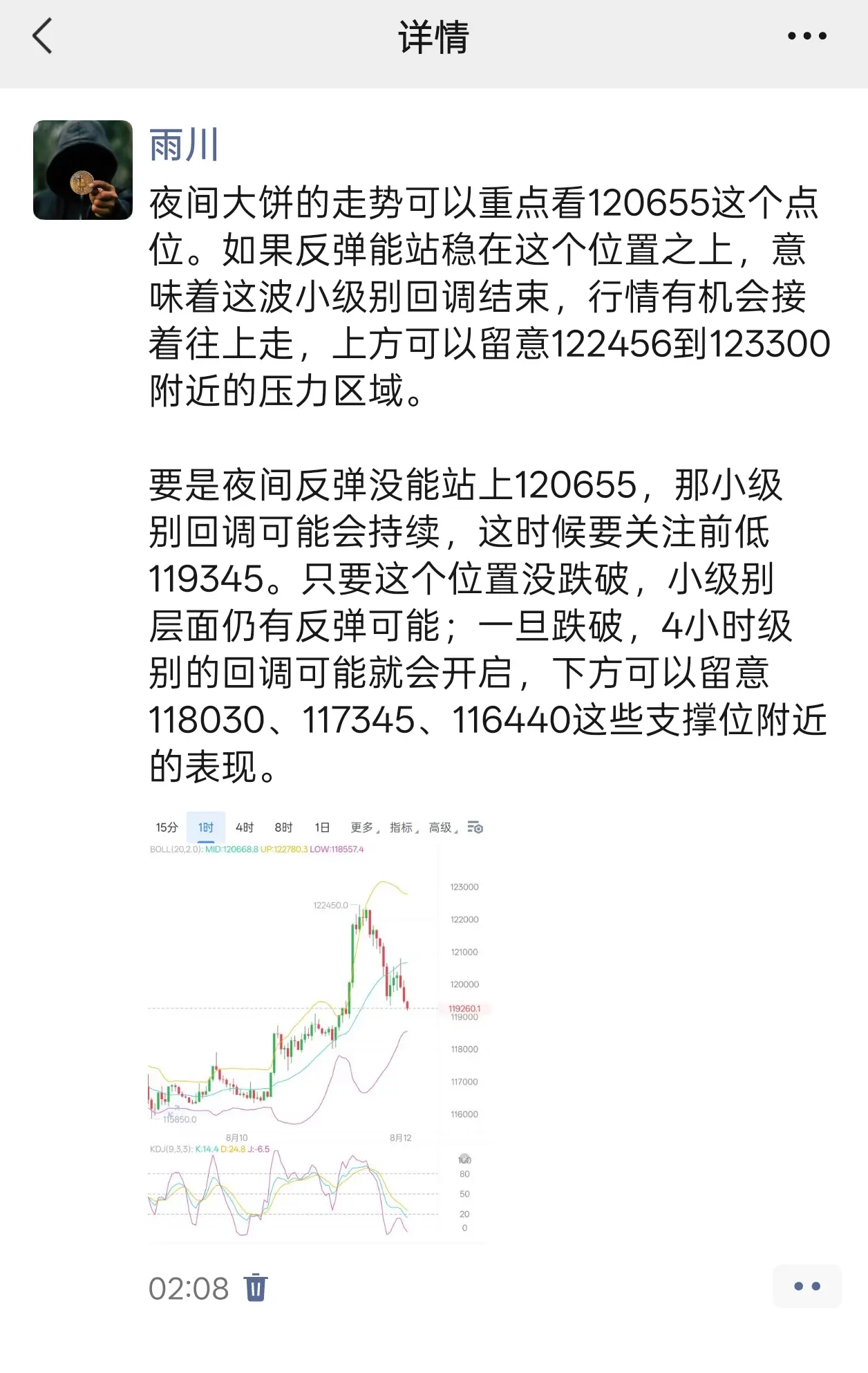

From a four-hour perspective, the price rebounded immediately after falsely testing the middle band support level of the Bollinger Bands, indicating strong buying pressure in this area, and the effectiveness of the support has been validated. This pullback has not formed an effective breakdown, suggesting that bearish momentum is insufficiently released and downward pressure is relatively eased. Moving forward, attention should be focused on the transition of long and short forces in the middle band area. If solid support can be established here, the price is expected

View OriginalFrom a four-hour perspective, the price rebounded immediately after falsely testing the middle band support level of the Bollinger Bands, indicating strong buying pressure in this area, and the effectiveness of the support has been validated. This pullback has not formed an effective breakdown, suggesting that bearish momentum is insufficiently released and downward pressure is relatively eased. Moving forward, attention should be focused on the transition of long and short forces in the middle band area. If solid support can be established here, the price is expected