Omni Network is developing a next-generation Rollup super network, enabling smart contract traders to get in early and capitalize on ecosystem growth.

Omni Network: A New Solution for Ethereum Scalability

While Layer 2 solutions have gone mainstream and Rollups have alleviated blockchain performance bottlenecks, they’ve also created a new challenge: each Rollup acts as an isolated data silo, restricting communication and data sharing. Omni Network was designed specifically to address this problem. Rather than simply serving as a bridge, it is a Layer 1 mainnet purpose-built for the entire Rollup ecosystem, enabling native, seamless transfer of information and assets between Rollups.

A Unified Interoperability Layer

Omni introduces the XMsg Protocol, a cross-chain messaging system that streamlines complex cross-Rollup interactions, delivering instant, efficient, and seamless operations. When a cross-chain action is triggered on any Rollup, Omni quickly verifies and executes it on the destination Rollup, ensuring users experience virtually no cross-chain latency. For developers, Omni offers the Omni EVM, an execution environment supporting one-click deployment and synchronized updates across multiple chains—dramatically reducing the effort required to launch DApps. Paired with its universal gas payment system, users can pay fees on any Rollup with either OMNI tokens or native assets, boosting the efficiency of cross-chain activities.

Dual Staking and Modular Design

Omni employs a Restaked ETH security model that blends both ETH and OMNI token staking, heightening the network’s resistance to attacks. At the consensus layer, the CometBFT mechanism delivers rapid finality and a highly modular structure, streamlining future upgrades and technological evolution. This forward-looking design not only strengthens transaction security but also equips Omni to handle large-scale application traffic, making it the ideal interconnection layer for the Rollup ecosystem.

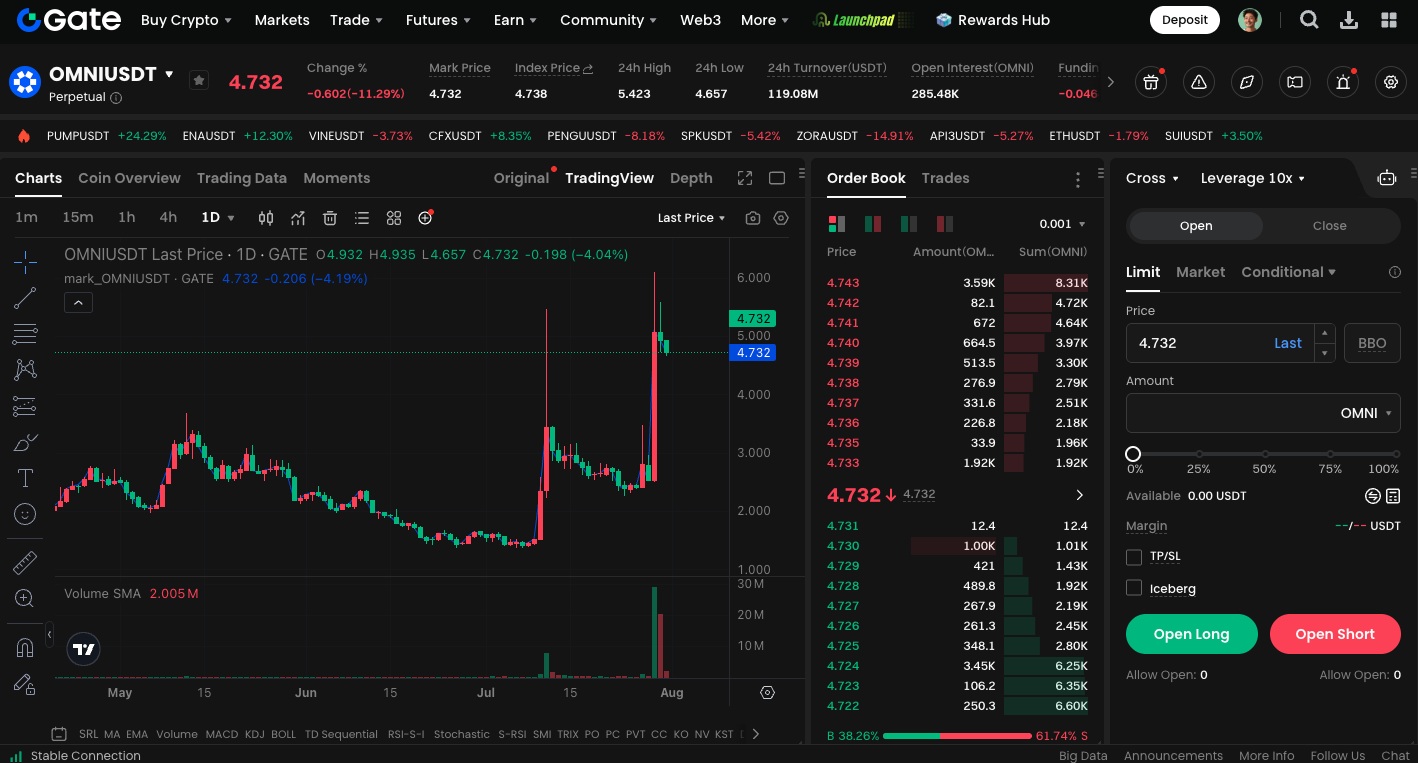

OMNI Futures: Early-Stage Exposure with Derivatives

For users less familiar with on-chain operations or investors seeking short-term exposure to Omni Network’s momentum, perpetual futures contracts provide a highly accessible avenue. Several exchanges—including Gate—now support OMNI/USDT perpetual futures (OMNI Futures), empowering users to participate in OMNI’s price movements via leveraged long or short strategies, all without directly holding the OMNI token. Through futures trading, investors can:

Capture OMNI price volatility during the project’s development phase

Leverage positions to amplify returns (with careful attention to risk)

Hedge or implement strategic trades without adjusting spot holdings

Start trading OMNI Futures right now: https://www.gate.com/futures/USDT/OMNI_USDT

Even if you haven’t joined the Omni ecosystem or participated in staking, you can still enter through derivatives trading and get ahead of the curve in this emerging network.

The OMNI Token: Utility and Value Beyond Governance

As the backbone of the Omni ecosystem, the $OMNI token is more than just a governance instrument; it plays a direct and crucial role in daily operations and network security, including:

Serving as the primary gas token for cross-Rollup transactions

Enabling staking and underpinning network security

Providing incentives for relayers, validators, and developers

Acting as the main fee token for deploying and executing applications on Omni EVM

With the liquidity introduced by OMNI Futures, demand for OMNI is expected to expand into off-chain markets, further solidifying its role as an asset and its price support.

Summary

Omni Network isn’t just a cross-chain protocol or a smart contract platform—it’s a Layer 1 mainnet that truly interconnects the entire Rollup ecosystem. Whether you’re a developer, on-chain investor, or a trader looking to get early exposure through futures, Omni provides the right pathway for you. As modular Rollup trends accelerate, Omni is positioned to be the bridge between chains, applications, and users—delivering on the promise of global Web3 interoperability.