Genius Stablecoin Bill: A New Era of Stablecoin Regulation in the U.S.

Background of the Legislation

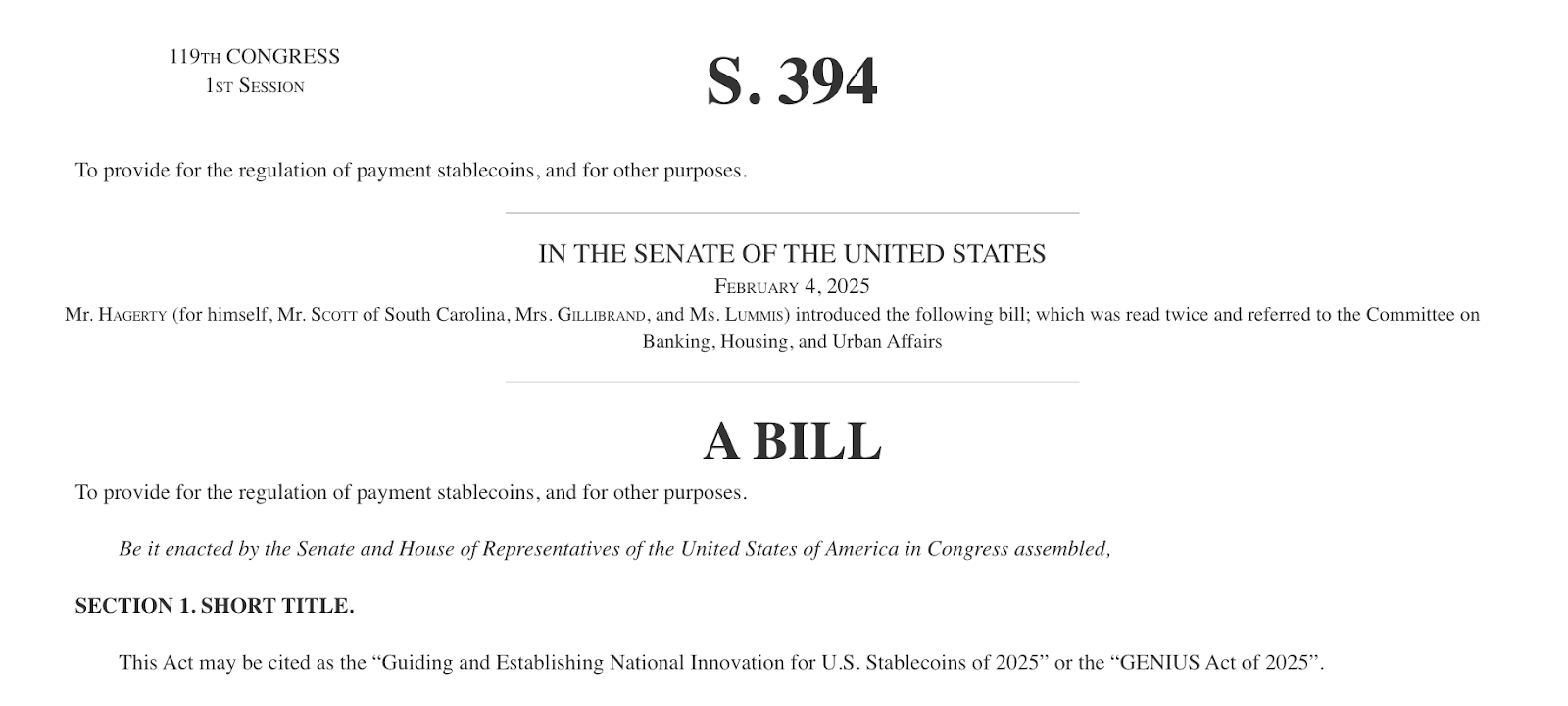

Image: https://www.congress.gov/bill/119th-congress/senate-bill/394/text

On July 18, 2025, the President of the United States signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, widely known as the Genius Stablecoin Bill. This groundbreaking law represents the first milestone regulation for digital assets in the U.S. Senator Hagerty and colleagues introduced the bill on February 4, 2025, and after extensive deliberations in both chambers of Congress, it passed with more rigorous compliance and oversight requirements. The Genius Stablecoin Bill establishes a comprehensive regulatory framework for the rapidly expanding stablecoin market, aiming to strike a balance between fostering innovation and managing risk.

Key Provisions of the Genius Stablecoin Bill:

- Licensing Requirement: Only authorized U.S.-based licensed payment stablecoin issuers or foreign issuers regulated under comparable regimes may issue and trade stablecoins under the Genius Stablecoin Bill in the U.S. market.

- Reserve Requirements: Stablecoins must be fully backed one-to-one or by highly liquid, low-risk assets of equivalent value.

- Audit and Transparency: Issuers must publicly disclose reserve status, fund usage, and operational details at least every six months.

- Liquidation and Bankruptcy Priority: Stablecoin holders have legal priority in asset liquidation proceedings if the issuer goes bankrupt. This helps to reduce investor losses.

- Regulatory Oversight: Smaller issuers may opt for state-level regulation, while larger issuers fall under the supervision of the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), or the Office of the Comptroller of the Currency (OCC).

Impact on Stablecoin Issuers

The Genius Stablecoin Bill sets a higher compliance bar for stablecoin issuers. This is likely to increase industry consolidation. On the other hand, the law provides compliant entities with a well-defined legal status and regulatory path. This creates strong opportunities to expand within the U.S. market. Licensed institutions will likely leverage U.S. Treasuries and other low-risk assets for more robust asset management and innovative product development.

Investor and User Protections

For investors and consumers, the new law offers more reliable value backing and settlement protections for stablecoins under the Genius Stablecoin Bill, reducing risks previously caused by opaque reserves or insufficient asset backing. Regular audits and disclosure measures provide greater transparency for investors, strengthening public trust in the ecosystem.

Industry Outlook

Looking forward, the Genius Stablecoin Bill will drive compliant, large-scale growth in the U.S. stablecoin market. However, the industry will also face critical challenges. These include finding the right balance between robust regulation and high compliance costs, and meeting the challenges posed by cross-border regulatory coordination and rapid technological evolution.