Decoding the Hong Kong Monetary Authority Document: Striking the Balance Between Rigor and Flexibility in Stablecoin Regulation

Hong Kong is accelerating the rollout of its stablecoin legislation.

On July 29, the Hong Kong Monetary Authority (HKMA) published the Regulatory Guidelines for Licensed Stablecoin Issuers along with its consultation summary, the “Guidelines on Anti-Money Laundering and Counter-Terrorist Financing (Applicable to Licensed Stablecoin Issuers)” and its consultation summary, plus two explanatory documents. These materials provide detailed execution rules for the stablecoin regulatory regime taking effect August 1.

Previously, on May 21, the Hong Kong Legislative Council formally passed the Stablecoin Ordinance, establishing a licensing system for fiat-backed stablecoin issuers.

From the ordinance’s passage to the release of supporting guidelines and full implementation, Hong Kong completed the “final mile” of its stablecoin regulatory framework in under three months.

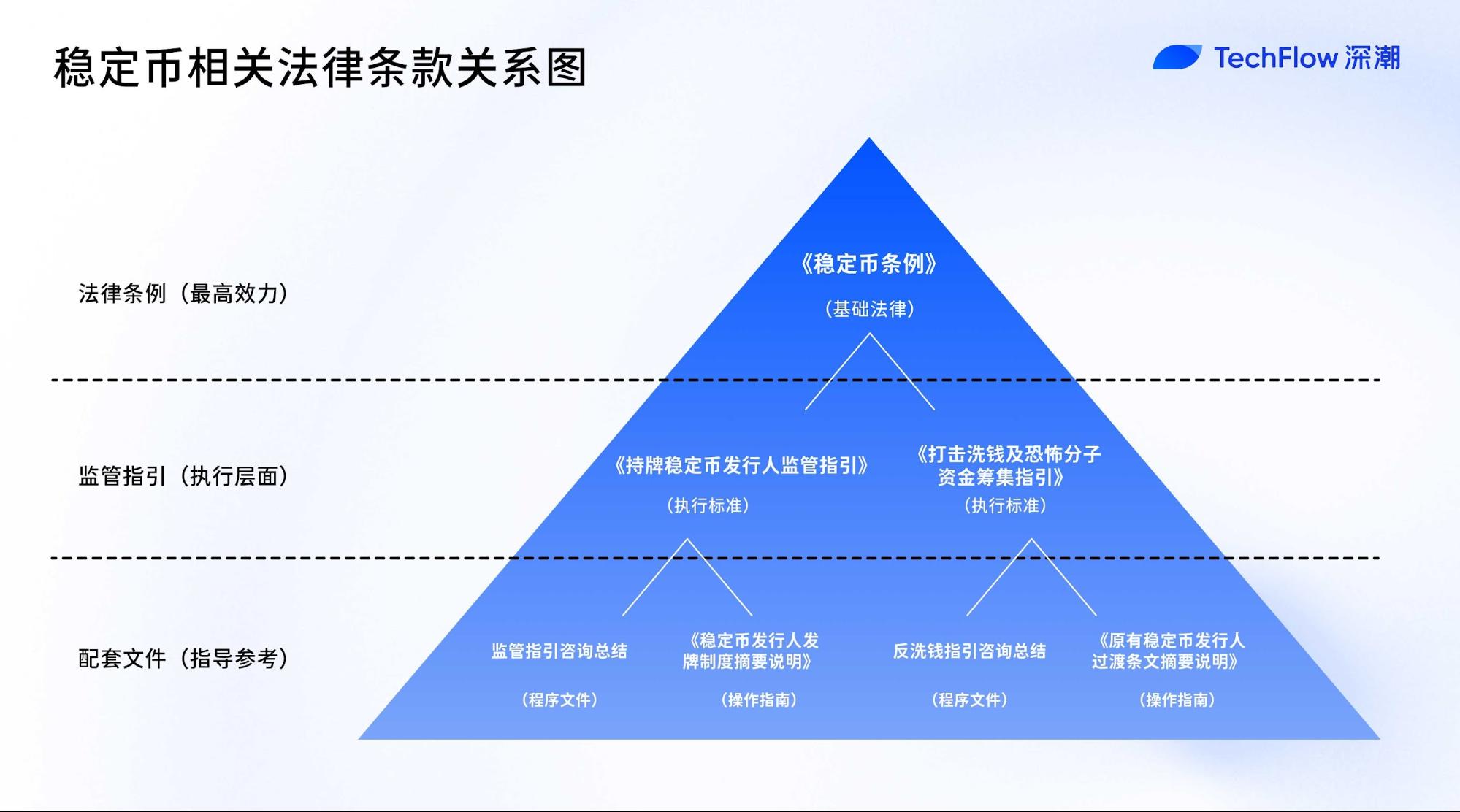

How are all these documents connected?

Hong Kong’s stablecoin framework includes: one ordinance (Stablecoin Ordinance), two sets of guidelines (with consultation summaries), and two explanatory documents—together creating a full chain from legal foundation to operational details and application instructions.

In detail, the regulatory documentation comprises:

- One foundational law: The Stablecoin Ordinance (published in May)

- Two sets of regulatory guidelines: Guidelines for Licensed Stablecoin Issuers and Guidelines on Anti-Money Laundering & Counter-Terrorist Financing

- Two consultation summaries: outlining the public consultation process and HKMA responses regarding the guidelines above

- Two explanatory documents: Overview of the Licensing Regime for Stablecoin Issuers and Overview of Transitional Provisions for Existing Stablecoin Issuers

The Stablecoin Ordinance sits atop the framework, establishing the legal foundation and structure for the stablecoin licensing regime. The two sets of regulatory guidelines translate the ordinance’s principles into concrete operational standards and compliance requirements. These guidelines have quasi-legal force and must be strictly followed by licensed institutions.

Consultation summaries serve a procedural function. While not legally binding, they document the regulator’s responses to market feedback and help stakeholders understand the regulatory intent and rationale behind the guidelines.

Explanatory documents provide interpretation and practical guidance for market participants, offering overviews of the regulatory system and license application instructions to help potential applicants better navigate compliance and process steps.

In short:

The ordinance “sets the rules”—defining what is a stablecoin, who can issue, and the fundamental regulatory principles;

The regulatory guidelines “set the standards”—providing technical provisions such as minimum capital, risk management, and disclosure requirements;

The explanatory documents “provide the roadmap”—detailing how to apply for a license, how the transition period is handled, and the regulator’s enforcement approach.

Licensed Stablecoin Issuer Guidelines: The “Strict” and “Flexible” Sides of the HK$25 Million Threshold

To streamline this analysis, we focus on the most central document: the Regulatory Guidelines for Licensed Stablecoin Issuers. This document spells out the concrete compliance requirements for issuers, directly shaping operations and affecting the interests of market participants.

If the Stablecoin Ordinance is the foundation for stablecoin issuance in Hong Kong, this 89-page set of Guidelines for Licensed Stablecoin Issuers is the stonework that brings structure to the house.

From a HK$25 million capital minimum to 12 strict requirements for private key management, the HKMA has mapped out a regulatory framework that is both rigorous and pragmatic—covering nearly every operational detail.

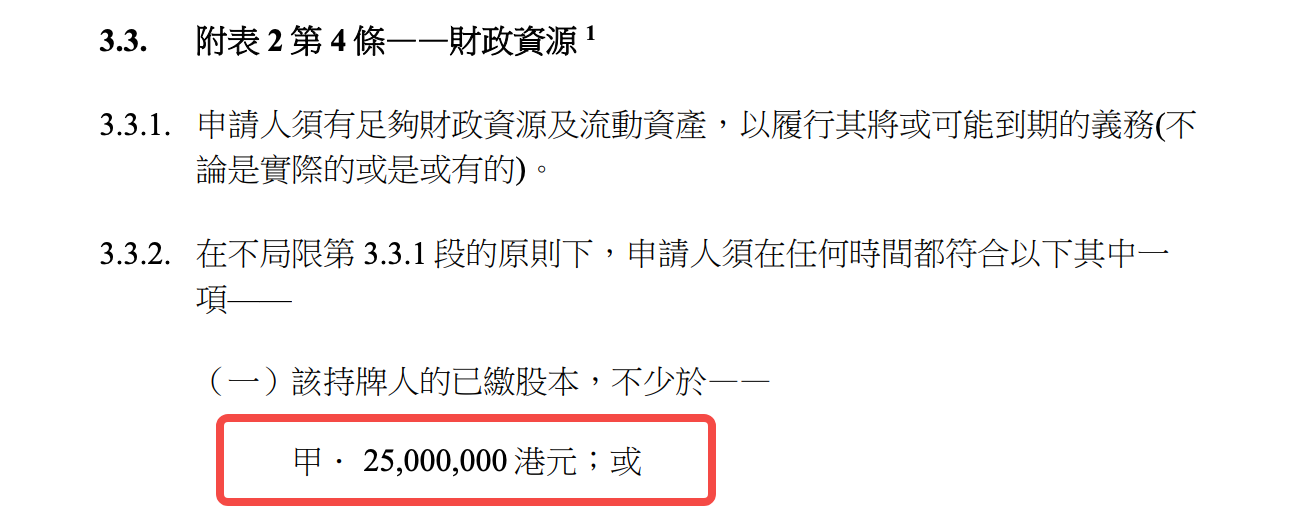

Entry Barriers: Not Everyone’s Game

The minimum capital threshold of HK$25 million (about USD 3.2 million) is on the high end globally for stablecoin regulation. For comparison: the EU’s MiCA requires a minimum capital of EUR 350,000 for e-money token issuers, while Japan’s threshold is JPY 10 million (roughly USD 75,000). Hong Kong’s level is clearly set to ensure both strong financial footing and continued access for innovators.

But capital is just the first filter. The “fit and proper” standard deserves particular attention.

The guidelines devote an entire chapter to seven major criteria, ranging from criminal background and business experience to financial strength and time commitment—even external board positions are scrutinized. Notably, at least one-third of the board must be independent non-executive directors—a standard mirroring listed company governance.

Practically, this means issuing stablecoins in Hong Kong requires not just money but “the right people.” Web3 startups built around tech founders may need to overhaul governance and introduce experienced financial professionals to meet compliance requirements.

Business activity restrictions go further: licensees must obtain prior written consent from the HKMA before engaging in any “other business activities.” This effectively classifies stablecoin issuers as “dedicated institutions,” akin to traditional payment providers or e-money issuers. For teams hoping to build an end-to-end “DeFi + stablecoin” ecosystem, this sends a clear signal to revisit their business models.

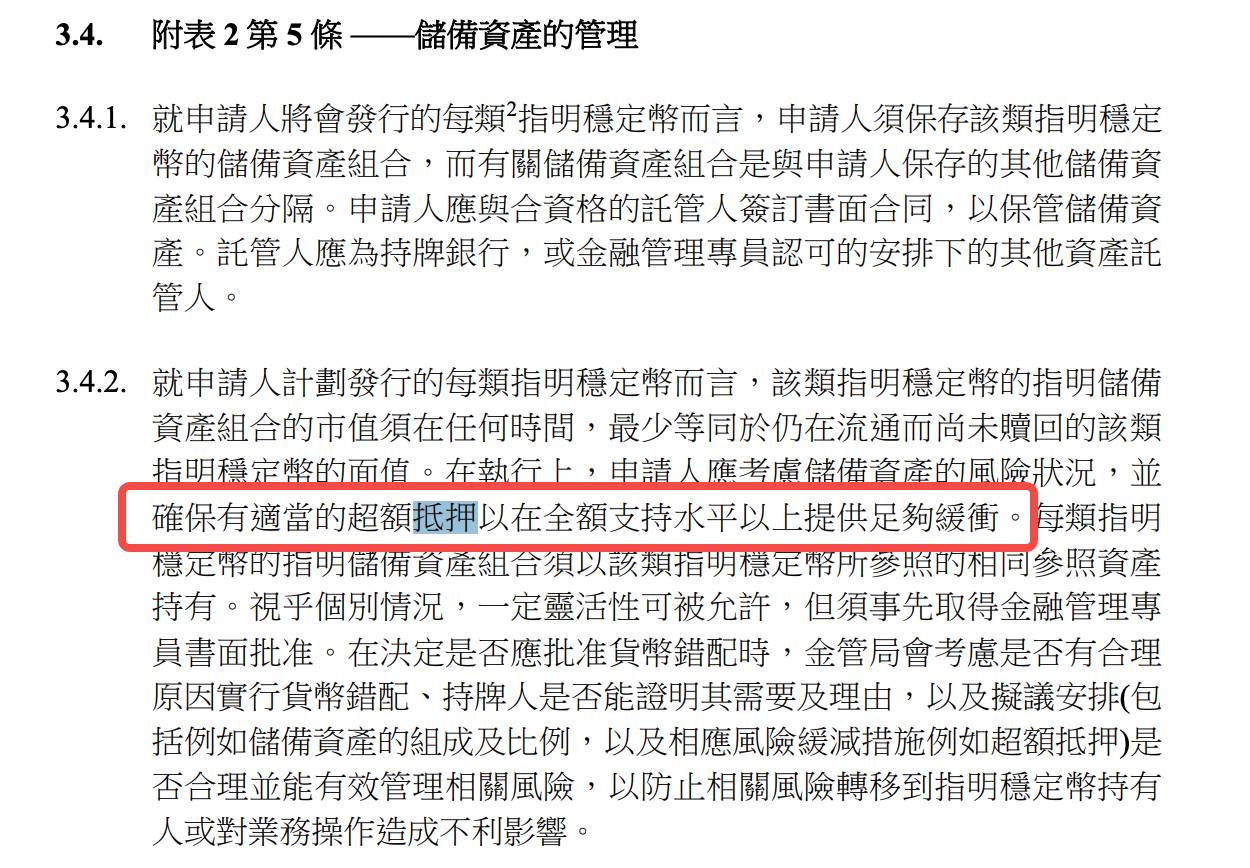

Reserve Management: 100% Coverage Is Only the Starting Point

Hong Kong mandates a “100%+ over-collateralization” approach to reserve asset management.

The guidelines require that the reserve asset market value must “at all times” at least equal the face value of stablecoins in circulation, and must “factor in reserve asset risk, ensuring appropriate over-collateralization.”

The guidelines do not specify what level is considered “appropriate.”

The guidelines do not stipulate a precise number, but given the requirements for market risk internal limits and periodic stress testing, the regulator expects issuers to dynamically adjust over-collateralization ratios based on risk conditions.

This “principle-based” approach grants flexibility but raises compliance costs—issuers must build robust risk assessment systems to justify their collateral levels.

When defining eligible reserve assets, Hong Kong demonstrates caution without stifling innovation.

Alongside traditional cash and short-term deposits, the guidelines explicitly allow “tokenized eligible assets.” Theoretically, tokenized U.S. Treasury securities or tokenized bank deposits could be used as reserves in the future.

The requirement for trust segregation is particularly noteworthy.

Licensees must establish “effective trust arrangements” to legally isolate reserve assets from proprietary assets, and must obtain independent legal opinions confirming their validity. This not only ensures legal isolation—even in bankruptcy, stablecoin holders’ rights are protected—but also goes beyond mere accounting segregation.

Transparency requirements are robust: issuers must disclose the composition and market value of reserves weekly, and obtain quarterly audits from independent auditors. For comparison, even leading compliant stablecoins like USDC only publish monthly reserve reports. Hong Kong’s requirements will elevate the bar for industry transparency.

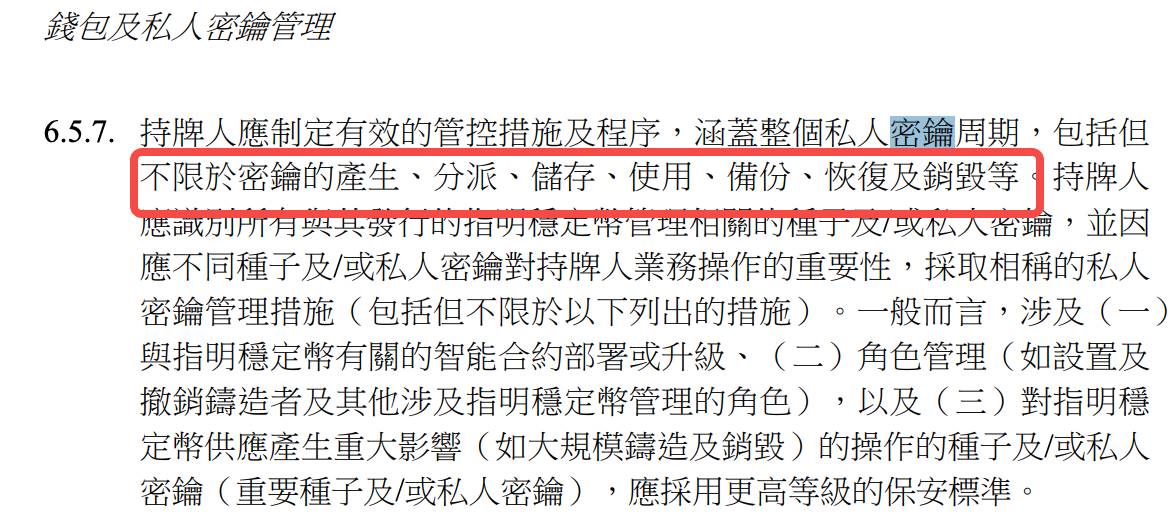

Technical Requirements: Enterprise-Grade Private Key Management

The guidelines show deep expertise in Web3 security, especially private key management:

From generation to destruction, physical security to breach response, 12 detailed requirements cover the full key lifecycle.

For example, “critical private keys must be used in an isolated environment”—private keys for minting or burning stablecoins cannot touch the Internet and must be managed completely offline;

“Multi-person authorization for key usage”—no single person may have unilateral access to critical keys;

“Key storage media must be in Hong Kong or other HKMA-approved locations”—offshore key custody is effectively prohibited.

These requirements show that the HKMA understands blockchain’s unique risks rather than simply transplanting legacy finance rules. In many respects, these guidelines represent a regulatory version of enterprise private key management best practices.

Smart contract audit requirements are also stringent: issuers must engage “qualified third-party entities” for contract audits before deployment, redeployment, or upgrades, verifying correct operation, functional match, and a high degree of security. Given the early stage of the smart contract audit industry, “qualified” status could remain an ongoing challenge.

Regarding customer identity verification, the guidelines blend Web3 features with traditional KYC.

Issuers must perform “relevant customer due diligence” before providing services, and “may only transfer stablecoins to pre-registered wallet addresses”—a design balancing user anonymity with regulatory compliance.

Operational Standards: A Bank-Like Model for Stablecoins

“T+1 redemption,” “pre-registered accounts,” and “three lines of defense”—these requirements show Hong Kong expects stablecoin issuers to match traditional finance in operational risk management.

Redemption timeframes, for example:

“Valid redemption requests must be fulfilled within one business day of receipt”—a T+1 requirement stricter than most current stablecoins. Tether reserves the right to delay or deny redemption, whereas Hong Kong makes timely redemption a legal duty.

But “banking” doesn’t mean rigid copying. The guidelines allow for flexibility in “exceptional circumstances”—licensees may delay redemption only with prior HKMA approval, using a mechanism similar to banks’ “withdrawal suspension” clauses to buffer systemic stress.

The three lines of defense are drawn from best-practice banking models:

The first line is business units; the second, independent risk management and compliance; the third, internal audit. For many Web3-native teams, this demands a structural overhaul—moving from flat tech teams to tiered organizations with clear accountability.

Third-party risk management is also stringent.

Whether for reserve custody, outsourced tech, or stablecoin distribution, any third-party arrangement requires rigorous due diligence and ongoing oversight. If third-party service providers are outside Hong Kong, the issuer must assess the local regulator’s data access capabilities and notify the HKMA promptly when required.

KYC: Does Every Holder Need to Register?

One of the most debated points on social media is KYC.

Some analyses have highlighted that the regulatory documents strictly require every stablecoin holder to undergo identity checks, implying full real-name registration.

Let’s look at the guideline language:

Although the guidelines distinguish between “customers” and “holders,” in practice, the division is largely theoretical—you can freely obtain and hold stablecoins, but to fully use them (i.e., redeem for fiat at will), KYC is nearly always required.

Several provisions appear flexible on their face:

- “Licensees shall only issue designated stablecoins to their customers.”

- “Terms and conditions shall apply to all designated stablecoin holders (whether or not they are customers of the licensee).”

This suggests there are two user types: KYC-verified “customers” and non-KYC “holders.” However, in practice, this distinction is largely theoretical.

The key is the redemption service provision: “No issuance or redemption service may be offered to a designated stablecoin holder or potential holder unless the relevant customer due diligence has been completed.”

In other words, to redeem, you must complete KYC and move from “holder” to “customer.”

Although the guidelines guarantee the right to redeem at face value—a core pillar of stablecoin stability—exercising that right always depends on your ability and willingness to pass KYC.

For those unable or unwilling to complete KYC due to privacy concerns, location, or other reasons, redemption is simply not an available option.

Geographic restrictions create another barrier.

The guidelines require issuers to “ensure designated stablecoins are not issued or offered in jurisdictions where they are prohibited,” and to “take reasonable measures to identify and block the use of VPNs.”

For globally oriented crypto users, these geofencing rules may be even more restrictive than KYC.

For Hong Kong itself, this may be a necessary compromise. Stricter access controls provide regulatory clarity and financial stability. Whether this model becomes the global industry standard is an open question.

Exit Mechanism: Proactive Safety Planning

Among all the regulatory requirements, the “business exit plan” may be the easiest to overlook — and the most crucial.

The guidelines require each issuer to maintain a detailed exit plan, covering everything from liquidating reserve assets and handling redemption requests to transitioning third-party services.

The regulator's deep concern for systemic risks is reflected in this requirement.

Because stablecoins, unlike other crypto assets, can quickly reach mass adoption due to their “stability” promise, any problems can have widespread effects. Requiring a preplanned exit pathway ensures that even worst-case scenarios can be managed in an orderly way.

Exit plans must address asset disposal strategies for “normal and stressed conditions,” i.e.:

If market liquidity dries up, how will reserves be liquidated without triggering a stampede? If a bank partner withdraws, how will redemptions continue?

How these scenarios are handled will determine a stablecoin’s ability to survive in a crisis.

The Deeper Logic of Hong Kong’s Regulatory Approach

Looking at the guidelines as a whole, Hong Kong’s stablecoin regulation is both distinctive and pragmatic. It is neither U.S.-style “enforcement-based” (compliance through investigations) nor European-style “rules-based” (detailed codification), but rather a “principles + rules” hybrid system.

For major risk points such as reserves and private key security, the guidelines specify detailed rules. For practical matters like collateralization ratios and risk metrics, there is room for principle-based flexibility.

This reflects a pragmatic understanding that rapid industry evolution renders inflexible rules obsolete fast.

The HK$25 million licensing threshold is high, but lower than the HK$50 million capital required for virtual asset exchange platforms. The technical requirements are rigorous, yet innovative forms like “tokenized assets” are explicitly accepted. Operating standards are demanding, but contingency planning is built in for market shocks.

Most importantly, this framework shows Hong Kong understands stablecoins as more than just “cryptocurrencies”; they are pivotal infrastructure connecting traditional finance and the digital economy. Regulatory standards must be high to safeguard financial stability, yet flexible enough to support ongoing innovation.

The message to market participants is clear:

Hong Kong welcomes responsible innovators—but be ready for robust oversight.

Any company seeking to issue stablecoins here must carefully assess its financial strength, technical resources, and compliance capabilities.

For the broader industry, Hong Kong’s example shows that smart regulation is not about stifling innovation, but about building fertile ground for it to thrive.

When rules are clear and implementation standards transparent, compliance costs are predictable and the boundaries for innovation are clearly defined.

Ultimately, this approach will help maintain Hong Kong's position as a global leader in digital assets.

Disclaimer:

- This article is reprinted from [TechFlow] and is copyrighted by the original author [David, TechFlow]. If you object to this reprint, please contact the Gate Learn Team. We will address the matter promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically cited, translated articles may not be copied, disseminated, or plagiarized.