Bitcoin Price Prediction: BTC Eyes $160K After New All-Time High

Is Bitcoin on Track for $160,000 Next?

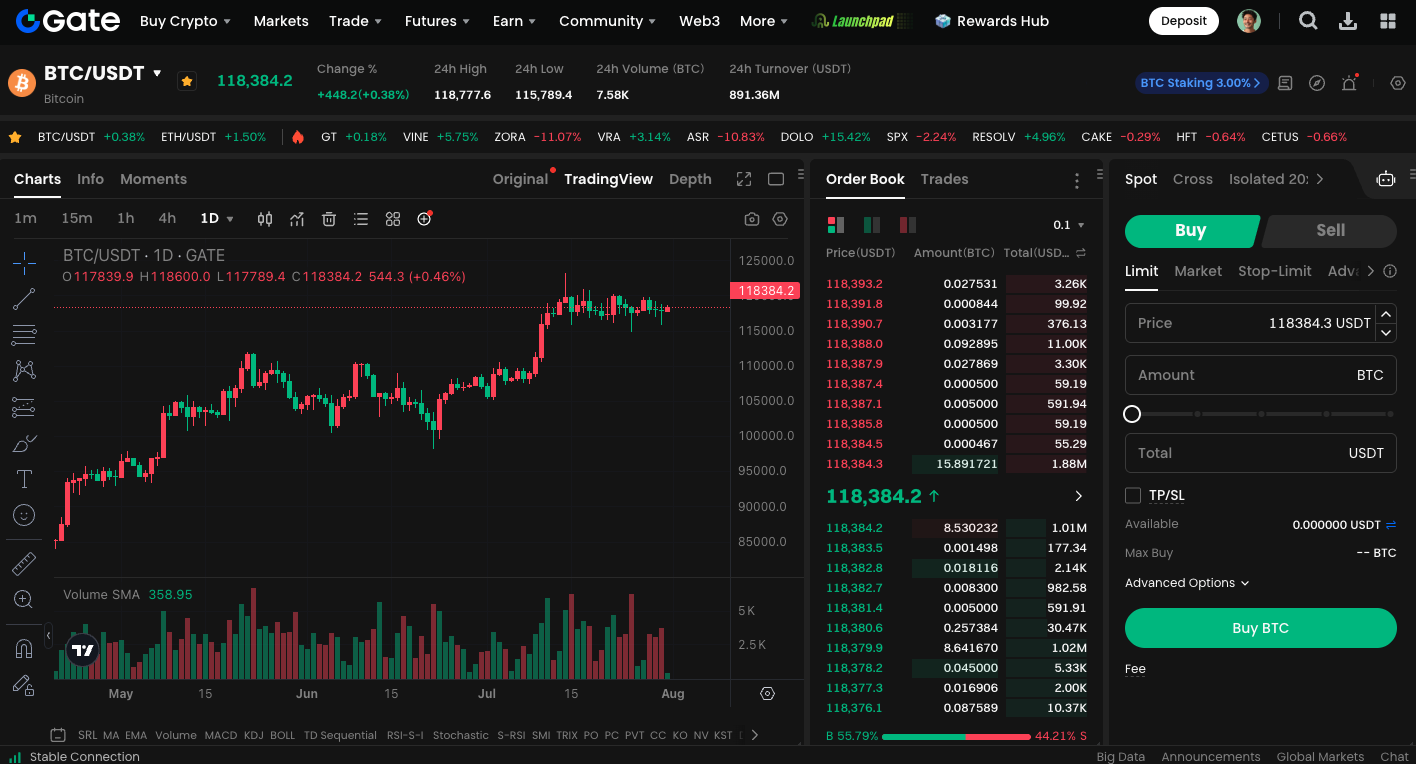

In mid-July, Bitcoin (BTC) surged past the $120,000 mark, reaching a new all-time high near $123,000. This momentum was largely fueled by substantial institutional investment. With the U.S. Congress beginning its discussions on crypto asset legislation this week, market optimism about Bitcoin’s prospects is running high. Both technical indicators and institutional views remain bullish: in the short term, Bitcoin could climb an additional 30%, and asset manager Bitwise projects a year-end gain of around 70%, directly targeting $200,000.

ETF Inflows Drive Rally

Recently, BTC’s surge has been powered primarily by ETF inflows. On just the first day of activity, BTC ETFs saw net inflows of $1.18 billion—a new 2025 record. Given that only about 450 new Bitcoins are minted each day, this buying pace vastly exceeds new supply, generating significant upward price pressure.

U.S. Bitcoin ETFs have attracted over $50 billion in total assets. BlackRock’s IBIT alone has drawn $53 billion, while Fidelity’s FBTC has recorded $12.29 billion in inflows. Bitwise CIO Matt Hougan commented, “This level of institutional investment represents a one-time structural shift, not a passing trend, and its full impact may take years to unfold.”

Technical Outlook Remains Bullish

According to Fibonacci extension analysis, BTC has already cleared the $112,000 resistance and achieved its first target of $120,000. Next, the key levels to watch are $136,000 and $160,000. While technical indicators suggest short-term corrections toward the $110,000–$100,000 range are possible, the broader trend remains firmly bullish.

Macro Trends

Beyond technicals and policy drivers, Bitcoin is increasingly regarded as a structurally scarce asset and a macro hedge, taking on roles traditionally filled by legacy assets. 10x Research notes that the U.S. federal deficit could balloon to $5 trillion over the next decade, positioning Bitcoin and gold as leading options for managing fiscal risk.

2025 Price Predictions

Even with current prices exceeding previous highs, many analysts believe BTC hasn’t peaked:

- Bitwise projects Bitcoin will hit $200,000 by year-end

- 10x Research estimates a 2025 target range of $140,000–$160,000

- BTC Markets analysts see a near-term test of $125,000 as pivotal

Overall, the $130,000–$150,000 range is considered a conservative projection, while expectations for $160,000–$200,000 are becoming increasingly mainstream among market participants.

Start BTC spot trading now: https://www.gate.com/trade/BTC_USDT

Summary

With tightening supply and demand, regulatory shifts, and ongoing institutional inflows, Bitcoin is in the midst of a powerful bull cycle. Even if short-term volatility arises, as long as the technical structure holds, any declines could represent prime buying opportunities for the next upward move.