Why is it said that ETH Treasury is more likely to increase in value than Strategy?

While the crypto community has long been enthusiastic about tokenizing traditional assets and bringing them on-chain, the most significant recent progress has actually come from the reverse—integrating crypto assets back into traditional securities. The recent surge in public market demand for “crypto treasury” stocks well exemplifies this trend.

Michael Saylor pioneered this approach via MicroStrategy (MSTR), pushing the company’s market cap past $100 billion and surpassing even Nvidia’s gains over the same period. We previously provided an in-depth analysis of MicroStrategy in a dedicated report—an excellent resource for those new to the treasury field. The core rationale of these treasury strategies is that public companies enjoy access to unsecured, low-cost leverage that ordinary traders cannot obtain.

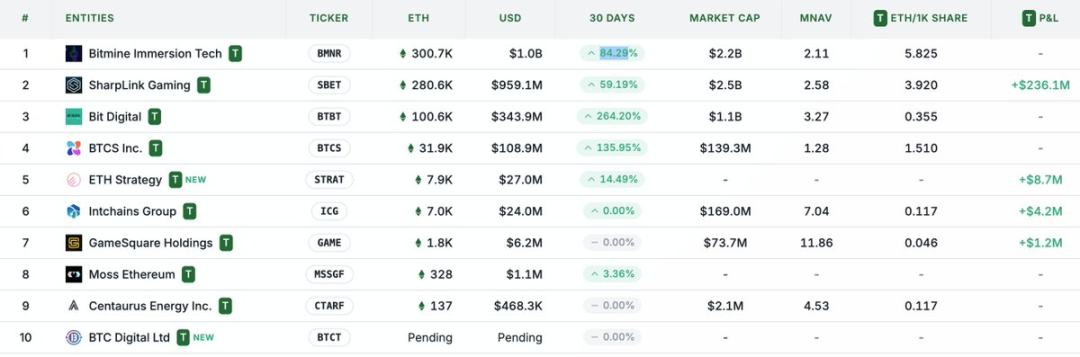

Recently, markets have shifted their attention from BTC treasuries to ETH treasuries, with notable examples such as Sharplink Gaming (SBET) led by Joseph Lubin and BitMine (BMNR) under Thomas Lee.

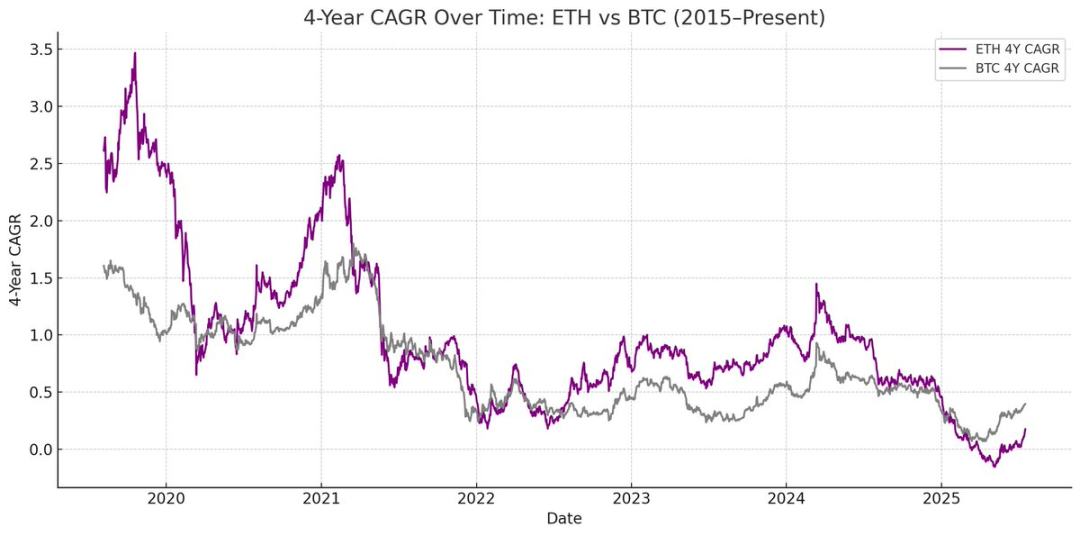

But are ETH treasuries truly viable? As we argued in our MicroStrategy report, treasury companies are essentially attempting to arbitrage the difference between the long-term compound annual growth rate (CAGR) of their underlying assets and their cost of capital. In earlier pieces, we outlined our outlook for ETH’s long-term CAGR: as a programmable, scarce reserve asset, ETH plays a foundational role in securing on-chain economic activity as more assets migrate to blockchain networks. This article lays out the bullish thesis for ETH treasuries and offers practical guidance for enterprises pursuing this strategy.

Liquidity Access: The Foundation of Treasury Companies

One of the primary reasons tokens and protocols create these treasury companies is to establish new pathways for accessing traditional finance (TradFi) liquidity—particularly as altcoin liquidity dries up. Treasury companies primarily acquire liquidity to boost their asset exposure through three mechanisms. Importantly, these liquidity and debt instruments are unsecured and cannot be redeemed prior to maturity.

- Convertible Bonds: Raising capital by issuing debt that can later be converted into equity, with the proceeds used to buy additional crypto assets.

- Preferred Equity: Issuing preferred stock with a fixed annual dividend to attract financing.

- At-the-Market Offerings (ATM): Selling new shares directly on the open market to obtain flexible, real-time capital for crypto purchases.

The Advantages of ETH Convertible Bonds

As detailed in our previous MicroStrategy research, convertible bonds offer institutional investors two key advantages:

Downside Protection with Upside Participation: Institutions can gain exposure to underlying assets (like BTC or ETH) while benefiting from the protective features of bonds.

Volatility-Driven Arbitrage: Hedge funds often use gamma trading strategies to profit from volatility in the underlying asset and related securities.

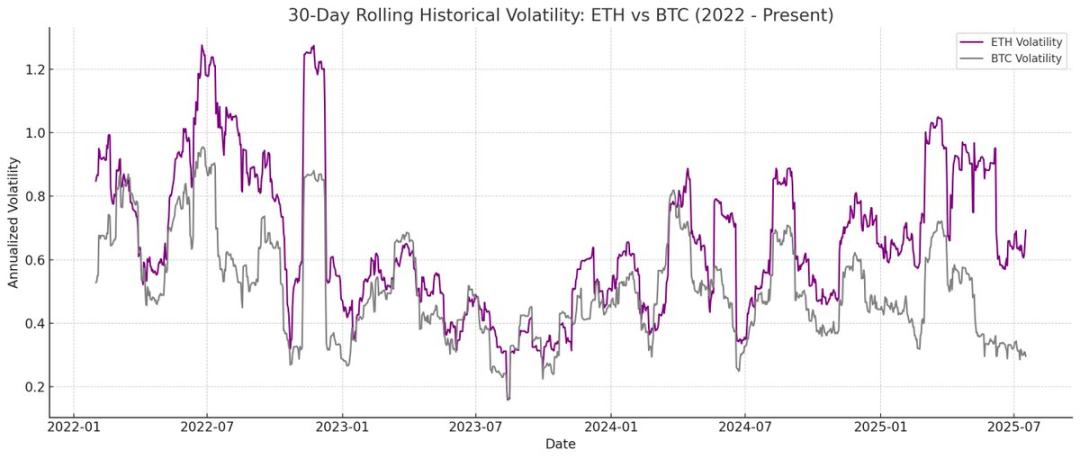

Hedge funds specializing in gamma trading strategies have become dominant in the convertible bond market. Compared to BTC, ETH historically displays greater realized and implied volatility. Convertible bonds issued by ETH treasury companies can reflect this heightened volatility within their capital structures, making them even more attractive to arbitrageurs and hedge funds. Crucially, this volatility enables ETH treasury firms to issue convertible bonds at higher valuations and secure more favorable financing terms.

Odaily Note: Historical volatility comparison between ETH and BTC.

For convertible bondholders, higher volatility means more opportunity to profit through gamma trading strategies. In short, the more volatile the underlying asset, the richer the gamma trading profits, putting ETH treasury convertibles at an advantage over those linked to BTC.

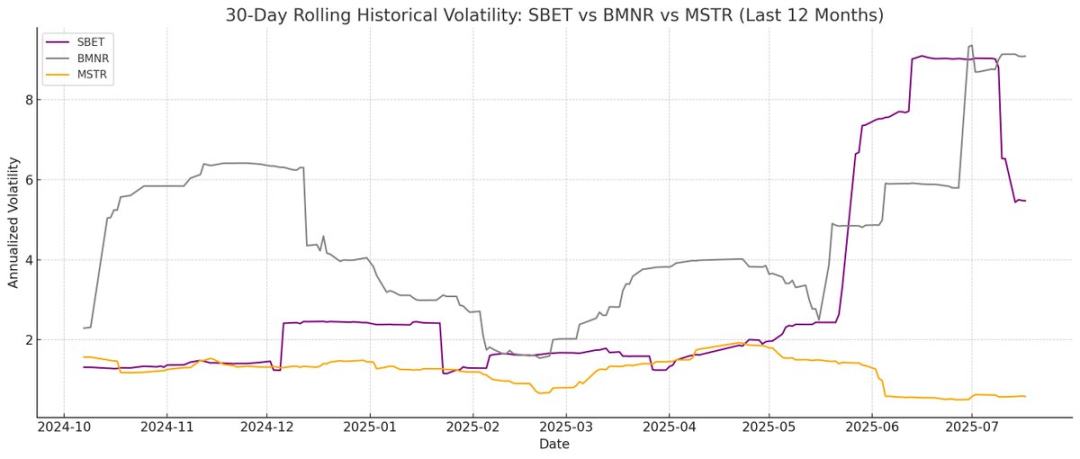

Odaily Note: Historical volatility comparison for SBET, BMNR, and MSTR.

However, it is important to note that if ETH fails to sustain long-term CAGR, the underlying asset’s value may not appreciate enough to trigger conversion before maturity, which puts the treasury company at risk of repaying the full principal. In contrast, BTC’s longer track record reduces the likelihood of this scenario; historical data shows most convertible bonds in this context ultimately convert into equity.

Odaily Note: Four-year CAGR comparison of ETH and BTC.

The Distinct Value of ETH Preferred Shares

Unlike convertibles, preferred shares are tailored for fixed-income investors. While certain convertible preferreds offer hybrid upside, yield remains the central focus for most institutions. The pricing of such instruments hinges on credit risk—whether the treasury company can reliably pay dividends.

MicroStrategy’s key advantage is using ATM offerings to fund interest payments. Because these offerings typically dilute just 1-3% of market cap, dilution risk remains low; however, this approach is still tied to the liquidity and volatility of BTC and MicroStrategy’s own equity.

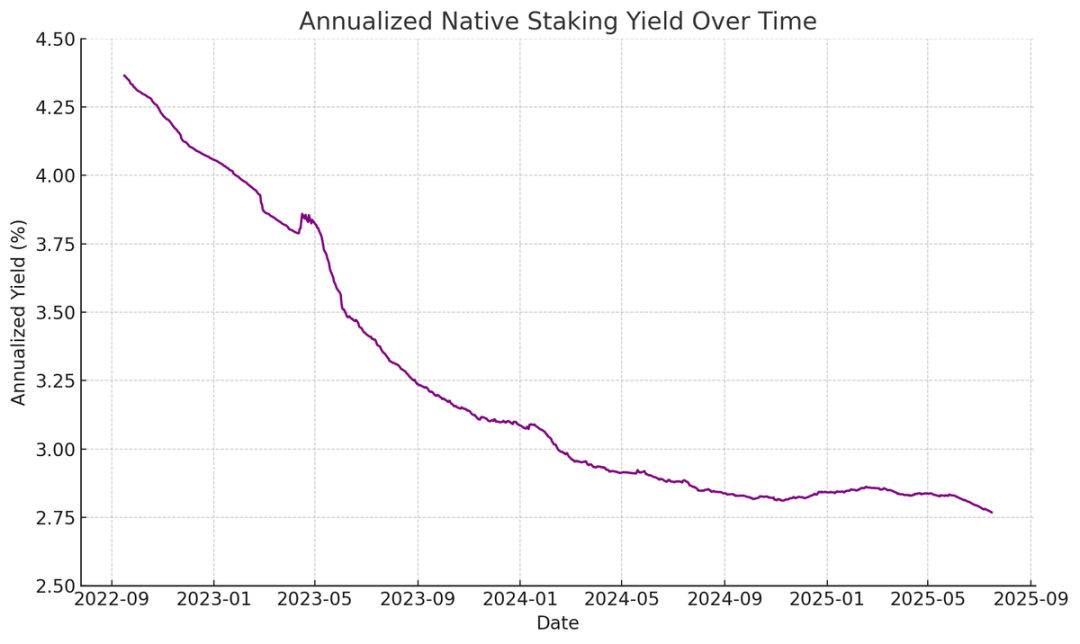

ETH, by contrast, can generate native returns via staking, restaking, and lending. This gives preferred shares more stable support for dividend payments and potentially warrants a higher credit rating. Unlike BTC, where returns stem only from price appreciation, ETH rewards combine long-term compounding growth with protocol-native yield.

Odaily Note: Annualized yield from native ETH staking.

One innovative concept: ETH preferred shares could serve as non-directional investment tools, enabling institutions to participate in network security without taking on ETH price risk. Our ETH report highlights that maintaining at least 67% honest validators is crucial for network security. As more assets are tokenized, institutional support for Ethereum’s decentralization and security grows ever more important.

Many institutions may hesitate to go long ETH directly, but ETH treasury companies can intermediate—absorbing directional risk while delivering fixed-income-like returns to institutions. SBET and BMNR’s on-chain preferred shares are designed as fixed-income staking products, bundling protocol-level incentives to appeal to yield-seeking investors who want to avoid full market risk.

ATM Issuances: A Strategic Edge for ETH Treasuries

The primary valuation metric for treasury companies, mNAV (market cap to net asset value ratio), is analogous to a price-to-earnings ratio, reflecting how the market prices each share’s future asset growth. ETH treasuries command a higher mNAV premium due to native yield mechanisms, which generate steady “earnings” and increase ETH per share without needing new capital. BTC treasuries, on the other hand, rely on synthetic yield strategies (like issuing convertibles or preferreds) and may struggle to justify returns when market premiums near NAV.

Crucially, mNAV is reflexive—a higher mNAV lets treasury companies raise capital more accretively through ATM sales. By issuing shares at a premium and increasing asset holdings, firms boost per-share value and establish a positive feedback loop. The higher the mNAV, the more value can be captured, which makes ATM issuance especially effective for ETH treasury companies.

Another major factor is capital access. Firms with deeper liquidity and diversified funding sources naturally secure higher mNAV, while those with limited market access typically trade at a discount. Thus, mNAV reflects a liquidity premium—a measure of market confidence in a company’s ability to secure additional financing.

Screening Treasury Companies by First Principles

ATM offerings are generally a retail funding mechanism, while convertibles and preferreds are geared toward institutions. The key to a successful ATM strategy is building a robust retail base, which demands a credible and charismatic leader as well as sustained, transparent strategy disclosures to earn lasting retail trust. In contrast, convertibles and preferreds require extensive institutional sales channels and capital markets relationships. By this rationale, SBET’s advantage is its retail momentum, driven by Joe Lubin’s leadership and the team’s ongoing transparency about the ETH backing per share, while BMNR, thanks to Tom Lee’s traditional finance network, is better placed to attract institutional liquidity.

Ecosystem Impact and Competitive Landscape of ETH Treasuries

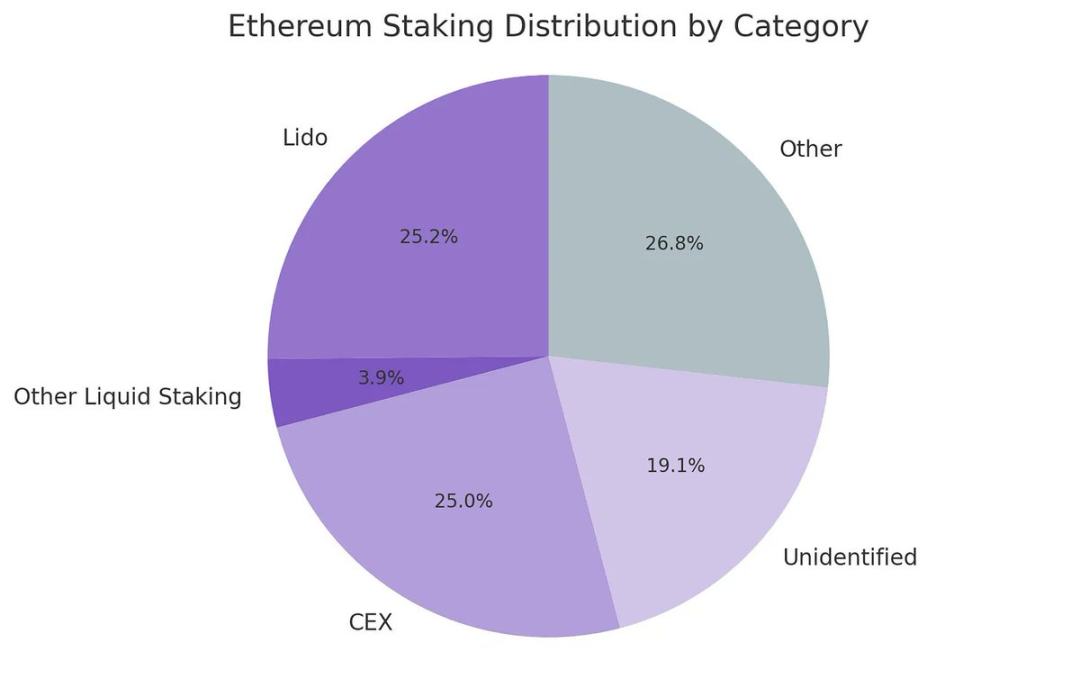

One of Ethereum’s biggest challenges is the increasing centralization of validators and staked ETH—mainly with liquid staking protocols like Lido or centralized exchanges such as Coinbase. ETH treasury companies help counteract this by promoting validator decentralization. For long-term resilience, these firms should diversify ETH across multiple staking providers and, when possible, operate their own validator nodes.

Odaily Note: Distribution of Ethereum staking types.

Against this backdrop, I expect the competitive landscape for ETH treasuries to differ fundamentally from their BTC counterparts. Bitcoin’s ecosystem has become winner-take-all (MicroStrategy holds over ten times more BTC than the next largest company), cementing first-mover advantage and narrative dominance in the convertibles and preferreds market. By contrast, ETH treasuries are starting from scratch with multiple projects running in parallel and no single dominant player. This absence of a first-mover advantage benefits the network’s health and fosters greater competition and accelerates development. With leading companies holding similar amounts of ETH, SBET and BMNR are likely to form a duopoly in the ETH treasury space.

Odaily Note: Comparison of ETH treasury company holdings.

Valuation Framework: Combining MicroStrategy and Lido

Broadly, the ETH treasury model can be viewed as a hybrid of MicroStrategy and Lido, tailored for traditional finance. Unlike Lido, ETH treasury firms capture a much greater share of value appreciation by holding the underlying assets, which gives them a clear advantage in value accumulation.

For context, Lido currently oversees around 30% of staked ETH, with an implied valuation topping $30 billion. We believe that, within a single market cycle (four years), SBET and BMNR could together surpass Lido in scale, driven by the velocity, depth, and self-reinforcing nature of traditional finance capital flows into crypto—demonstrated by MicroStrategy’s growth playbook.

As additional background: Bitcoin’s market cap is $2.47 trillion and Ethereum’s is $428 billion (about 17-20% that of Bitcoin). If SBET and BMNR reach 20% of MicroStrategy’s $120 billion valuation, their combined long-term value would be about $24 billion. Currently, these two firms together are valued at less than $8 billion, indicating significant potential for growth as ETH treasuries mature.

Conclusion

The emergence and growth of digital asset treasuries mark a major step in the convergence of crypto and traditional finance, with ETH treasuries quickly establishing themselves as a potent new force. Ethereum’s unique advantages—including greater convertible bond volatility and native yields for preferreds—offer distinctive growth channels for treasury firms. Their ability to drive validator decentralization and competitive dynamics further differentiate them from BTC treasury bond ecosystems.

The combination of MicroStrategy’s capital efficiency and ETH’s embedded yield could unlock vast value and accelerate the integration of on-chain finance into traditional markets. The rapid pace of expansion and increasing institutional interest signal that crypto and capital markets are poised for transformative change in the coming years.

Disclaimer:

- This article is reprinted from [TechFlow], with copyright belonging to the original author [Penn Blockchain Co-Investment Director Kevin]. If you have concerns about this republication, please contact the Gate Learn team. The team will respond promptly following our standard procedures.

- Disclaimer: The views and opinions expressed herein are those of the author only and do not constitute any investment advice.

- Other language versions of this article were translated by the Gate Learn team. Do not reproduce, distribute, or plagiarize translated articles without clearly crediting Gate.com.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

An Introduction to ERC-20 Tokens

What is Neiro? All You Need to Know About NEIROETH in 2025

Our Across Thesis