Shiba Inu Price Prediction: SHIB Holds $0.000013 After Pullback, Structural Shift Could Fuel 15% Rally

SHIB Price Retraces to Key Support

Shiba Inu (SHIB) recently experienced a price correction, retreating from its previous high of $0.000016 to around $0.000013. Despite this, SHIB remains above a critical support level from a technical perspective. In the short term, there’s some risk of testing the 50-day moving average, but mid-term momentum could strengthen again after a period of consolidation. Rather than focusing on short-term price swings, the key development is SHIB’s ongoing structural transformation. It is evolving from a highly speculative memecoin to an asset increasingly positioned for long-term holding.

Nearly 80% Held by Long-Term Investors

According to data from IntoTheBlock, approximately 80% of SHIB’s circulating supply is now held in wallets that have held their tokens for over one year. This marks a decline of more than 10% in short-term traders compared to the same period last year. Meanwhile, the proportion of long-term holders has increased. This shift highlights that more investors are viewing SHIB as a patient, long-term asset. Such a change in holding structure makes SHIB less susceptible to short-term sell-offs and eases sharp declines. While this may reduce explosive upside in the short run, it strengthens SHIB’s resilience to market volatility and forms a more stable price floor.

New Burn Mechanism Goes Live on Base Chain

The SHIB ecosystem has recently rolled out a major initiative for supply control. The team announced that a new burn engine is now active on the Base blockchain, which will continue to automatically burn SHIB tokens through on-chain activity, thereby increasing scarcity.

For example, in Zora’s Creator Coin campaign, each user transaction generates a creator fee used to burn SHIB. In a single 24-hour window, over 600 million SHIB were burned—reinforcing expectations of token deflation. This initiative demonstrates the team’s commitment to building long-term price support, signaling a shift from meme status toward a more functional ecosystem.

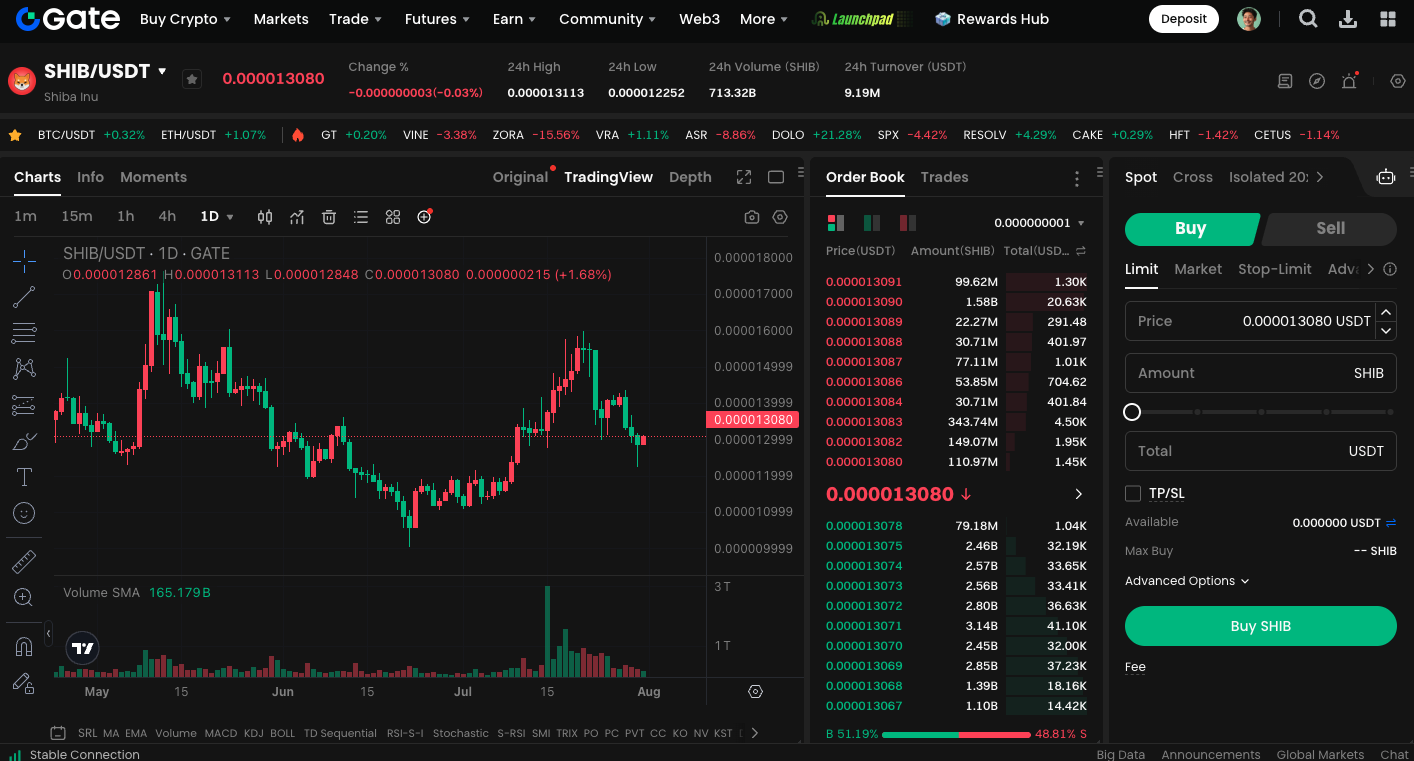

SHIB Technical Analysis

In the near term, if SHIB holds above $0.000013, it could challenge the resistance zone at $0.000015, representing roughly 15% upside. Technical indicators show that selling pressure persists, but the RSI has not yet entered oversold territory, indicating that downside support remains strong. If the burn mechanism and large-holder support continue, SHIB could experience a new upward trend in the third quarter.

Start trading SHIB on the spot market now: https://www.gate.com/trade/SHIB_USDT

Summary

Shiba Inu is no longer just a hotspot for short-term speculators—it’s steadily transitioning into a long-term investment asset. Structural supply contraction, changing user behavior, and the influx of large-scale investor capital suggest SHIB may be entering a new, more stable growth phase. For investors, SHIB may not deliver rapid daily gains. However, it now presents a clearer mid- to long-term value proposition.