Performance Review of 8 Major Blockchains Over the Past 3 Months: Ethereum Reclaims the Throne, Base and Hyperliquid Surge

In the past three months, the crypto market has seen a significant rebound. Major public blockchains have taken center stage, with Ethereum making a powerful comeback driven by both ETF fund inflows and buying from public companies. Solana, Sui, Hyperliquid, and others have also posted substantial gains. Judging by the price action, the market may be entering a long-awaited altcoin season. However, the underlying performance of these public blockchains warrants closer examination.

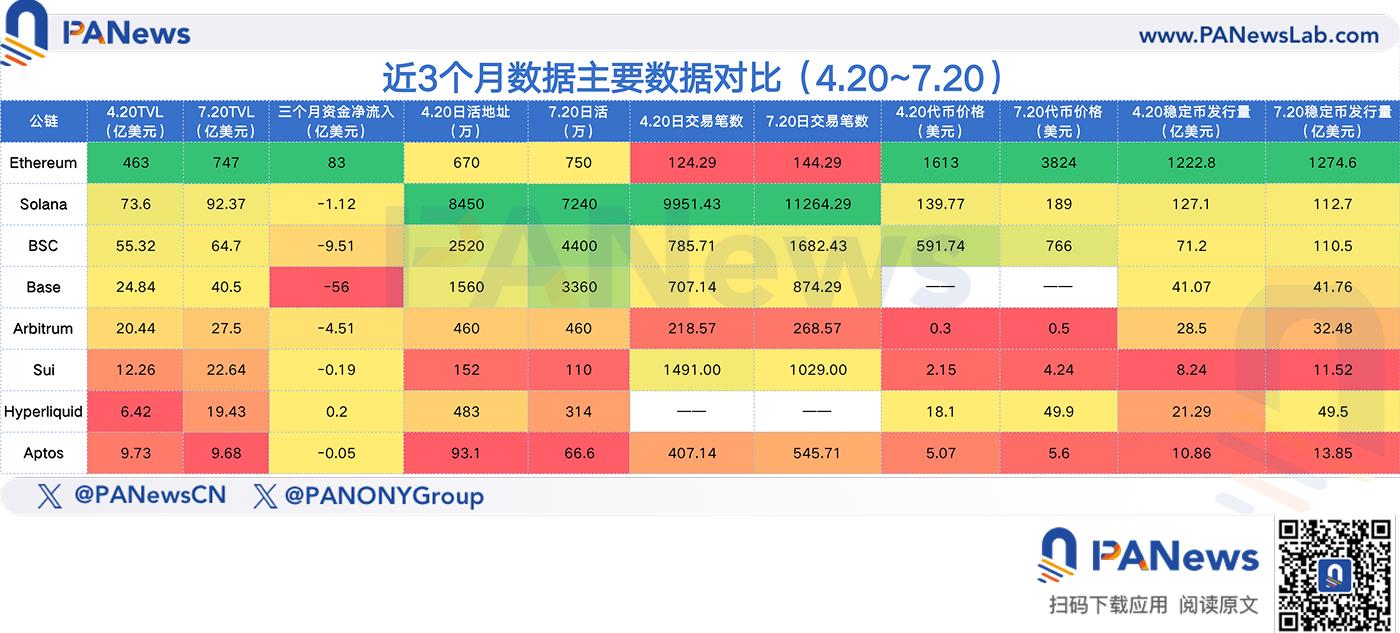

This article analyzes eight leading public blockchains—chosen for their high TVL and market attention—across five key metrics over the past three months: price, TVL, capital flows, on-chain activity, and ecosystem development. The data reviewed spans from April 20 through July 20.

Ethereum: The Return of the King, Powered by Capital

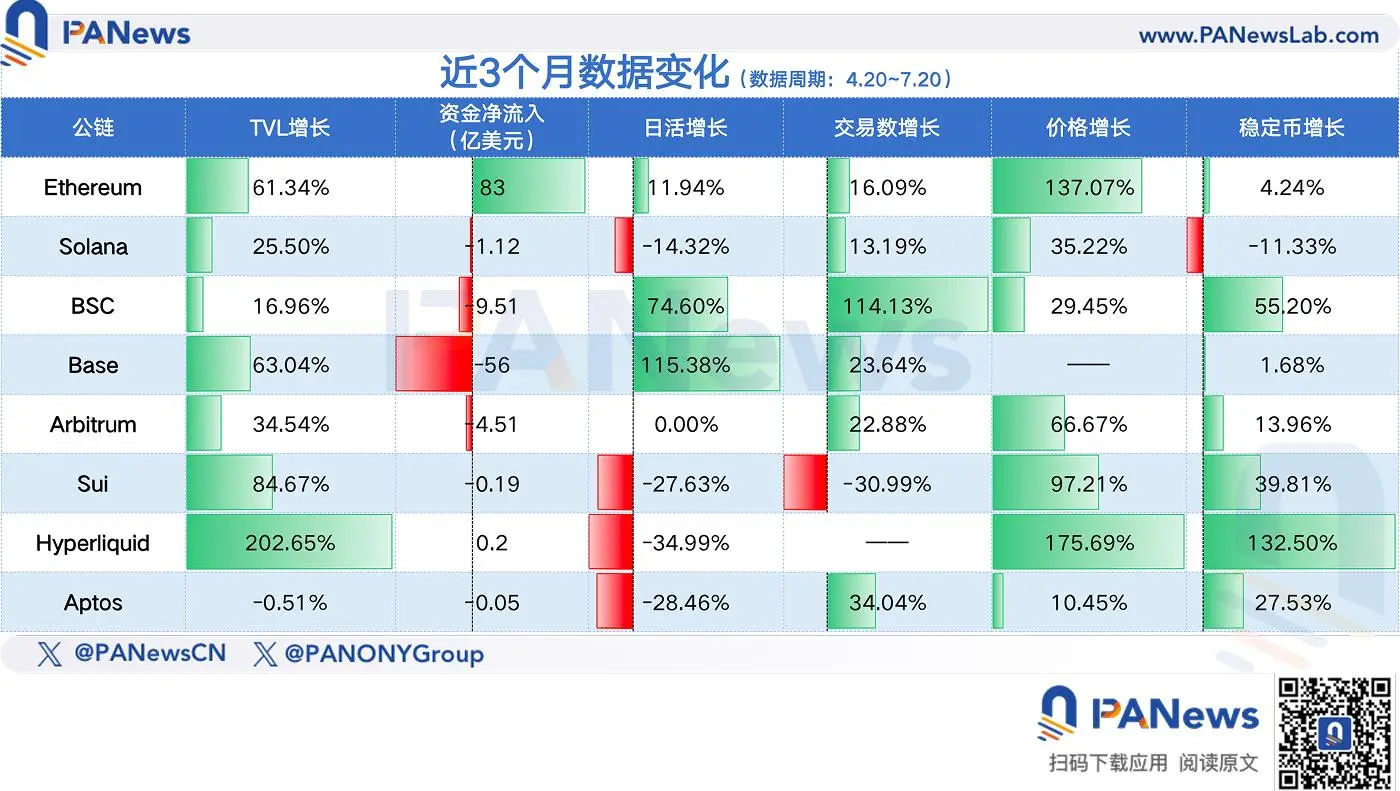

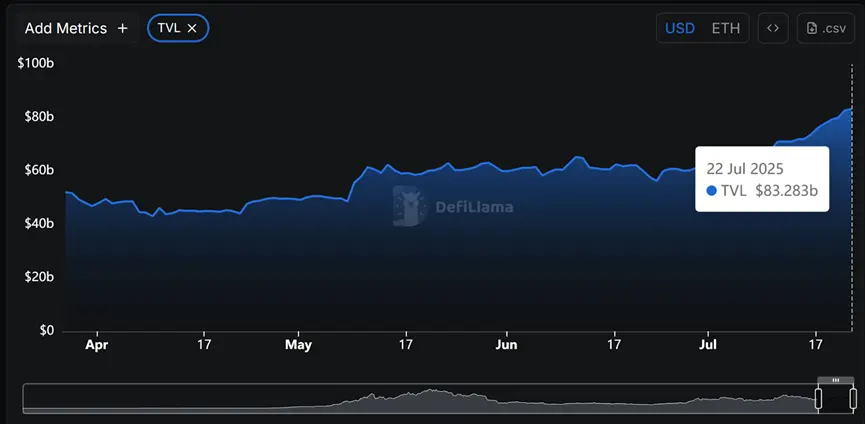

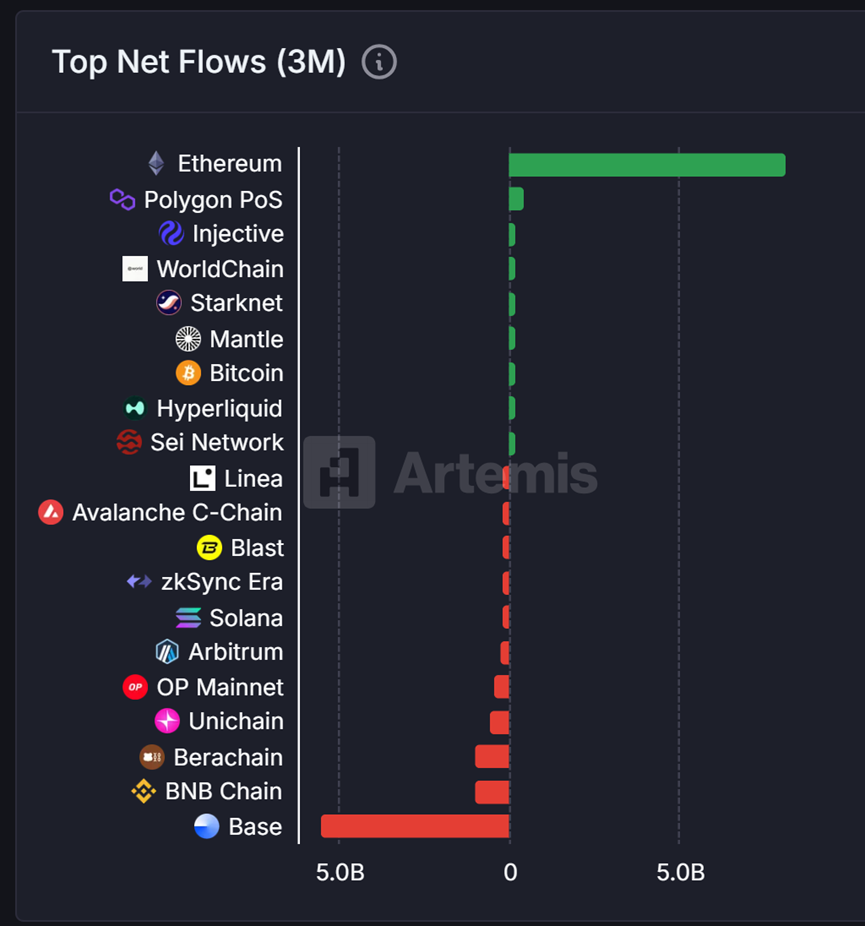

Ethereum has shown marked improvement across all major indicators recently, closely tracking its price surge. Over the past three months, ETH rose from $1,600 to a high above $3,800—an increase of over 130%. Accompanying the price rally, Ethereum’s ecosystem TVL grew by 61.34%, with a net inflow of $8.3 billion in on-chain capital, once again topping all public blockchains. However, most of the TVL growth resulted from ETH’s price gains. In terms of ETH holdings, the total ETH locked in the ecosystem has trended downward, falling from 28.39 million in April to about 22.28 million, a 21% decrease.

On-chain, daily active addresses and transaction counts were up 11.94% and 16%, respectively, over three months—solid, but not dramatic. Ethereum spot ETFs saw about $5 billion in net inflows during this time. Several U.S. listed companies followed MicroStrategy’s lead, adopting ETH as a reserve asset, further fueling buying and bullish sentiment. Overall, the rally in ETH price appears primarily capital-driven.

Solana: Market Cap Recovery Faces Headwinds as Activity Drops

In contrast to Ethereum, SOL’s price also surged—from $139 to a peak of $189. Yet ecosystem data tells a different story: Solana saw a net outflow of $112 million in on-chain capital over three months, and daily active addresses dropped 14%. Stablecoin issuers reduced supply by $1.5 billion.

TVL rose from $7.3 billion to $9.237 billion. Within Solana’s ecosystem, Pump.fun maintained its status as the leading trading platform, generating $234 billion in trading volume in the past month. Notably, OKX DEX broke into the top ten with $4.6 billion in monthly volume—an unexpected development.

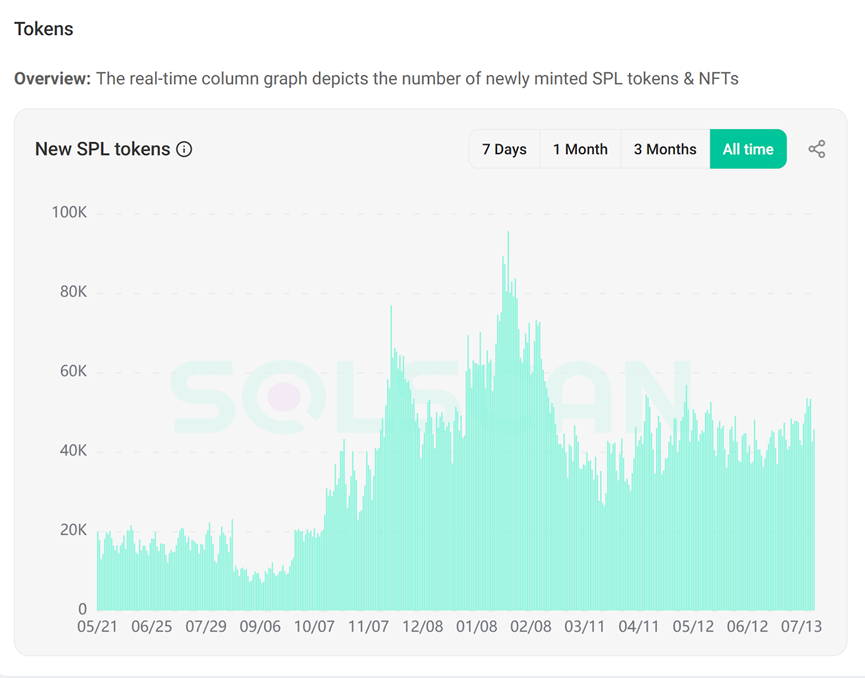

Regarding meme coin issuance, Solana is now seeing about 40,000–50,000 new tokens issued daily, down sharply from 90,000–100,000 in January. However, issuance remains stable, with no sudden collapse.

Solana’s staking rate is approximately 66%, but the number of validators is decreasing—suggesting big validators are consolidating control at the expense of smaller operators.

BSC: Alpha Campaigns Drive On-Chain Resurgence

BSC shows an almost opposite pattern to Solana. BNB’s price rose nearly 30% in three months—not eye-popping, but on-chain metrics soared. Daily active addresses leapt from 25.2 million to 44 million (up 74.6%), daily transactions more than doubled from 7.85 million to 16.82 million (up 114%), and stablecoin supply jumped from $7.12 billion to $11 billion (up 55%). These sharp upticks likely result from user engagement driven by Alpha campaigns.

Despite these gains in usage, BSC saw a net outflow of $950 million over three months. The key challenge ahead will be converting this activity boost into sustained capital retention.

Base: High-Speed Growth Channels Value to Ethereum

Base posted standout numbers too: TVL jumped from $2.4 billion to $4 billion (up 63%) over three months. Daily active addresses surged from 15.6 million to 33.6 million (up 115%), and daily transactions climbed 23%. Paradoxically, Base saw $5.6 billion in net outflows—the most among any public chain. Most of this capital ended up on Ethereum, making Base Ethereum mainnet’s largest source of capital inflows over the period.

Base has also deployed Flashblocks, slashing block times from two seconds to just 200 milliseconds, making it the fastest EVM chain today. Coinbase’s launch of Base App, a unified social and trading platform, is expected to accelerate ecosystem expansion.

Arbitrum: Gaining Strength as L2’s Number Two

Arbitrum’s core metrics remained steady, except for a 34% gain in TVL and a 22% rise in transactions. Daily active addresses held flat at 4.6 million. ARB, however, rallied 66%—a strong performer among major public blockchains, likely due to Ethereum’s price surge. Arbitrum remains securely the number-two Ethereum L2.

Sui: TVL and Price Take Off in Tandem

SUI’s price nearly doubled, soaring from $2.15 to $4.24 (up 97%). Underlying data supports this move: TVL spiked from $1.2 billion to $2.2 billion (up 84%), and stablecoin issuance topped $1 billion. Sui’s daily active addresses dipped from 1.5 million to 400,000 from May to June. They rebounded to 1 million in early July—still short of prior highs.

Hyperliquid: Blasting Off After the Trust Crisis

Hyperliquid saw the steepest climb among public blockchains, with its token price skyrocketing from $18 to $49.90 and market cap breaking $15 billion—ranking 13th overall.

On-chain, TVL more than tripled from $640 million to $1.943 billion (up 202%). Stablecoin issuance surged from $2.1 billion to $4.9 billion, now fifth among all chains. After a prior decentralized trust crisis, Hyperliquid’s HLP treasury profit hit a new record, surpassing $68 million. Since July, daily new users have once again topped 3,000.

Aptos: Underperforming Amid Market Slowdown

Compared with other major chains, Aptos had underwhelming metrics. The price climbed only 10% in three months, while TVL, capital flows, and daily active addresses all declined. The standout positives: daily transactions jumped 34%, and stablecoin issuance rose by $300 million. Against Sui, also built on the MOVE language, Aptos trails on most critical indicators.

In summary, on-chain data is not matching the intensity of the token price spike this cycle. Sui, Hyperliquid, and Base have seen real gains, but these still lag behind their price moves. Clearly, capital flows are leading ecosystem growth in this recovery. Whether these price gains will spark true ecosystem development—such as a resurgence in DeFi, blockchain games, or real-world adoption—remains to be seen. In the long run, it is likely that on-chain data and fundamentals will become major drivers for future price action.

Disclaimer:

- This article is reprinted from PANews with copyright held by the original author Frank, PANews. For any concerns regarding this reprint, please contact the Gate Learn team. We will address such matters promptly according to our established process.

- Disclaimer: The opinions and views expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Copying, distribution, or adaptation of translated content is prohibited unless Gate is explicitly cited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge